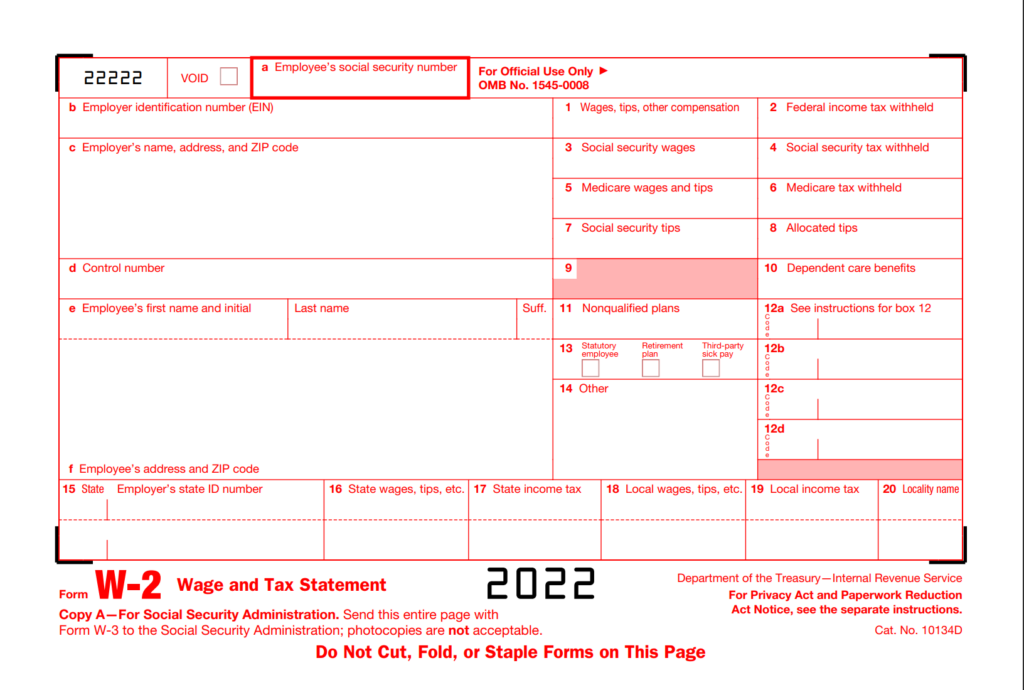

Skip the Dishes Employee W2 Form – Form W-2, likewise known as the Wage and Tax Statement, is the file an employer is required to send out to each worker and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees’ yearly incomes and the amount of taxes kept from their incomes. A W-2 employee is someone whose company subtracts taxes from their paychecks and submits this details to the government.

How Can I Receive My W-2?

Your employer is required to offer you with copies of your W-2 each year if you are qualified to get one. The due date for business to supply this form is normally by the end of January or early February following the tax year that simply ended. W-2s might be sent by mail as a paper copy or provided online in electronic form, either through the employer straight or by means of their payroll provider.

Download W2 Form 2022

How to Get Your Former Employer to Send You Your W-2 Form

You may be wondering how to get your W-2 form from your old employer if you are a former staff member. There are a few various ways to set about getting this document.

The first thing you can do is call the HR department of your old company. You can explain that you need a copy of your W-2 form and ask them to mail it to you. They will likely ask for your address so they can send it out or email it to you.

Another choice is to call the business’s accountant or accountant and inquire for the file. They might have access to all of the company’s records, which implies they will have the ability to provide you a copy of your W-2 form without any trouble on their end.

If you need to find more information related Skip the Dishes Employee W2 Form please check the curated link listed below :

SkipTheDishes Courier Portal

https://couriers.skipthedishes.com/

Filing Your 2021 Taxes SkipTheDishes Courier Help Centre

https://courier-help.skipthedishes.com/hc/en-ca/articles/1500002419042-Filing-your-2021-taxes

Q Why Does Skip Send A Summary Of Earnings SkipTheDishes

https://promo.skipthedishes.com/tax-faqs/

Filing Tax Returns For Delivery Drivers Tips And Advice TurboTax

https://turbotax.intuit.com/tax-tips/self-employment-taxes/filing-tax-returns-for-delivery-drivers-tips-and-advice/L0UbcGiKQ

Filing Taxes For On Demand Food Delivery Drivers TurboTax Intuit

https://turbotax.intuit.com/tax-tips/self-employment-taxes/filing-taxes-for-on-demand-food-delivery-drivers/L7dIkSK6I

Couriers Ask Your Tax Questions Here R Skipthedishes Reddit

Couriers: Ask Your Tax Questions Here

by u/SkipDriverCalgary in skipthedishes

Become A Food Delivery Courier Drive With SkipTheDishes

https://couriers.skipthedishes.com/application

Viewing Your Earnings SkipTheDishes Courier Help Centre

https://courier-help.skipthedishes.com/hc/en-ca/articles/1500001303962-Viewing-your-earnings

Working At SkipTheDishes Employee Reviews Indeed

https://www.indeed.com/cmp/Skipthedishes/reviews

General Instructions For Forms W 2 And W 3 2022

https://www.irs.gov/instructions/iw2w3