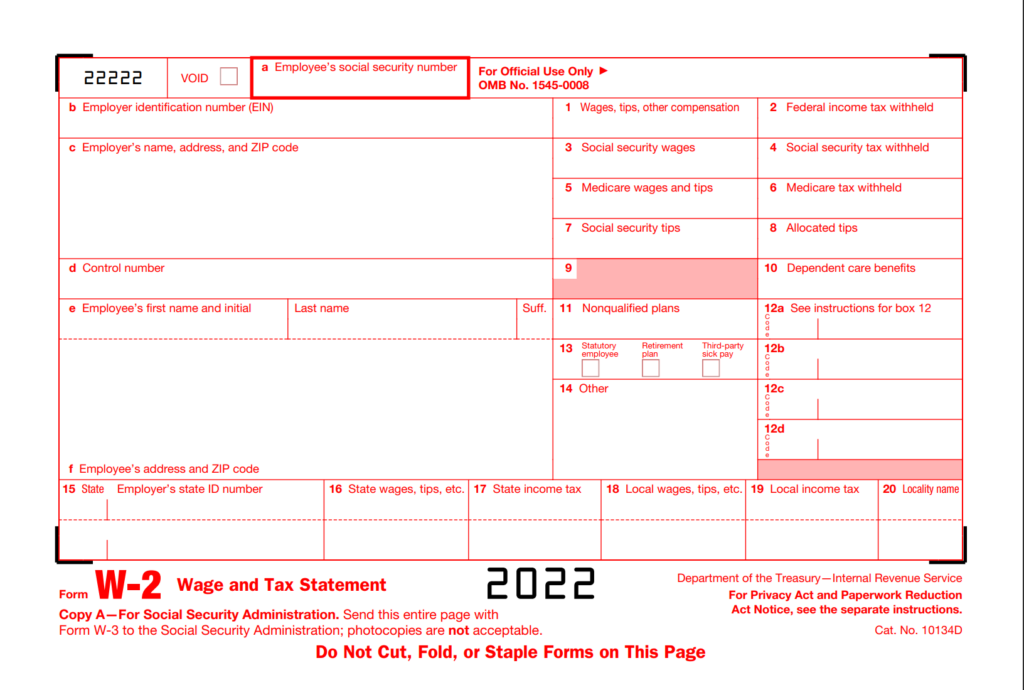

Pick n Pay Employee W2 Form – Form W-2, likewise known as the Wage and Tax Statement, is the document an employer is required to send out to each worker and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports staff members’ annual wages and the quantity of taxes withheld from their incomes. A W-2 employee is someone whose employer deducts taxes from their paychecks and submits this details to the government.

How Can I Receive My W-2?

If you are eligible to receive one, your company is needed to provide you with copies of your W-2 each year. The deadline for business to provide this form is generally by the end of January or early February following the tax year that simply ended. W-2s might be sent by mail as a paper copy or offered online in electronic form, either through the company straight or by means of their payroll provider.

Download W2 Form 2022

How to Get Your Former Employer to Send You Your W-2 Form

You may be questioning how to get your W-2 form from your old company if you are a former worker. There are a few different ways to set about getting this file.

The first thing you can do is call the HR department of your old employer. You can describe that you need a copy of your W-2 form and inquire to mail it to you. They will likely request for your address so they can send it out or email it to you.

Another option is to get in touch with the business’s accountant or bookkeeper and ask them for the document. They may have access to all of the business’s records, which means they will be able to provide you a copy of your W-2 form without any hassle on their end.

If you need to find more information related Pick n Pay Employee W2 Form please check the curated link listed below :

What You Need To Know About The Difference Between W2 And 1099

Taxes W2 Statements UCPath

https://ucpath.ucsd.edu/benefits-payroll/payroll/w2-statements.html

Paychecks W2 Forms Dartmouth

https://www.dartmouth.edu/finance/employee-services/other_services/employee_self_service/paychecks_w2_forms.php

About Form W 2 Wage And Tax Statement Internal Revenue Service

https://www.irs.gov/forms-pubs/about-form-w-2

PAIA Manual Pick N Pay

https://www.pnp.co.za/pnpstorefront/paia-manual

How To Fill Out A W 2 Tax Form For Employees SmartAsset

https://smartasset.com/taxes/how-to-fill-out-your-w-2-form

3 Ways To Send Forms W 2 To Your Employees The Motley Fool

https://www.fool.com/the-ascent/small-business/articles/how-to-send-w2-to-employees/

How To Get Your W 2 From A Previous Employer Steps And Tips

https://www.indeed.com/career-advice/career-development/how-to-get-w2-from-previous-employer

Hire And Manage Employees Small Business Administration

https://www.sba.gov/business-guide/manage-your-business/hire-manage-employees

What Is A Form W 2 How To Get A Wage Tax Statement

https://www.nerdwallet.com/article/taxes/what-is-w-2-form