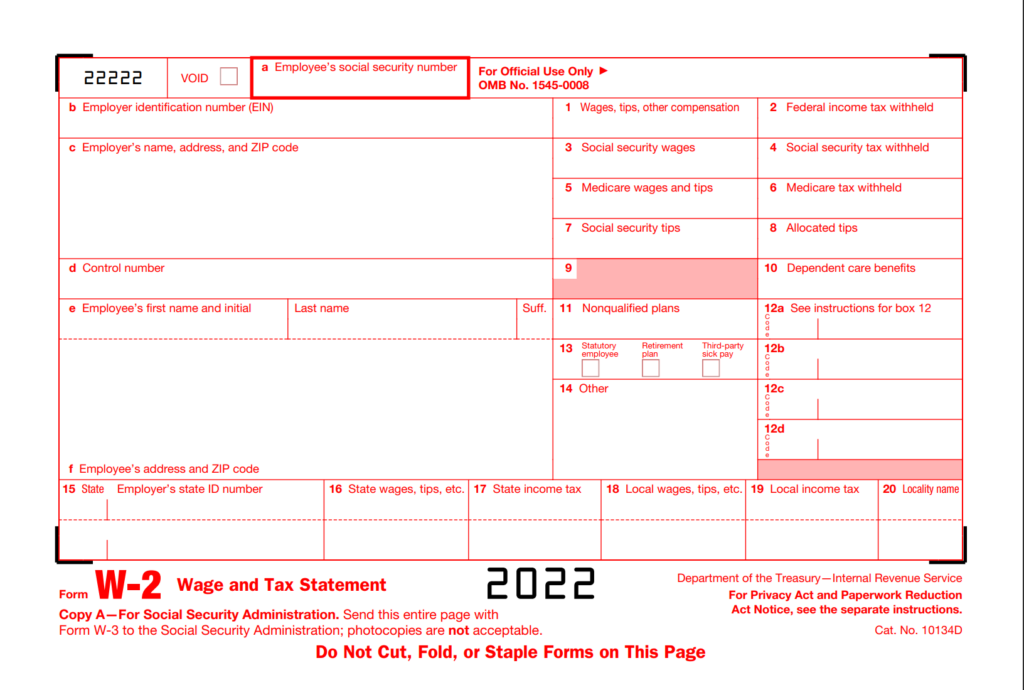

Avon Employee W2 Form – Form W-2, likewise known as the Wage and Tax Statement, is the file a company is required to send to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports workers’ yearly incomes and the quantity of taxes withheld from their paychecks. A W-2 employee is someone whose employer deducts taxes from their incomes and submits this info to the federal government.

How Can I Receive My W-2?

If you are qualified to receive one, your employer is required to offer you with copies of your W-2 each year. The deadline for business to offer this form is typically by the end of January or early February following the tax year that just ended. W-2s might be sent by mail as a paper copy or provided online in electronic form, either through the employer straight or by means of their payroll supplier.

Download W2 Form 2022

How to Get Your Former Employer to Send You Your W-2 Form

You might be questioning how to get your W-2 form from your old company if you are a former employee. There are a couple of various methods to set about getting this file.

The first thing you can do is call the HR department of your old company. You can explain that you require a copy of your W-2 form and inquire to mail it to you. They will likely request for your address so they can send it out or email it to you.

Another choice is to call the company’s accounting professional or accountant and inquire for the file. They might have access to all of the company’s records, which means they will be able to give you a copy of your W-2 form without any inconvenience on their end.

If you need to find more information related Avon Employee W2 Form please check the curated link listed below :

Avon Representative Business Records Online Beauty Biz

https://onlinebeautybiz.com/avon-reps-business-records/

I Am An Avon Rep How Do I Report Income Expenses And Profit

https://ttlc.intuit.com/community/business-taxes/discussion/i-am-an-avon-rep-how-do-i-report-income-expenses-and-profit/00/720001

AVON REPRESENTATIVE PREPARING FOR TAX SEASON TIPS

Avon CT CPA Firm News Updates Page

https://www.timmccarthycpa.com/newsletter.php

RITA Municipality Avon Regional Income Tax Agency

https://www.ritaohio.com/municipalities/Home/MemberPage?id=020

Avon Ohio Code Of Ordinances CHAPTER 880 Income Tax

https://www.cityofavon.com/DocumentCenter/View/2592/Ordinance-No-145-15-Exh-A?bidId=

For Employees Cleveland Clinic

https://my.clevelandclinic.org/about/for-employees

Frequently Asked Questions Page Linda C Avon CT CPA Firm

https://www.knierimcpa.com/frequently-asked-questions.php?item=164&catid=33&cat=Nanny%20Tax%20Rules:%20Frequently%20Asked%20Questions

Payroll Administrator City Of Avon Lake

https://www.avonlake.org/human-resources/non-civil-service-job-listings/payroll-administrator

Employment Agreement Between Avon And Brian Connolly SEC Gov

https://www.sec.gov/Archives/edgar/data/8868/000119312507096891/dex102.htm