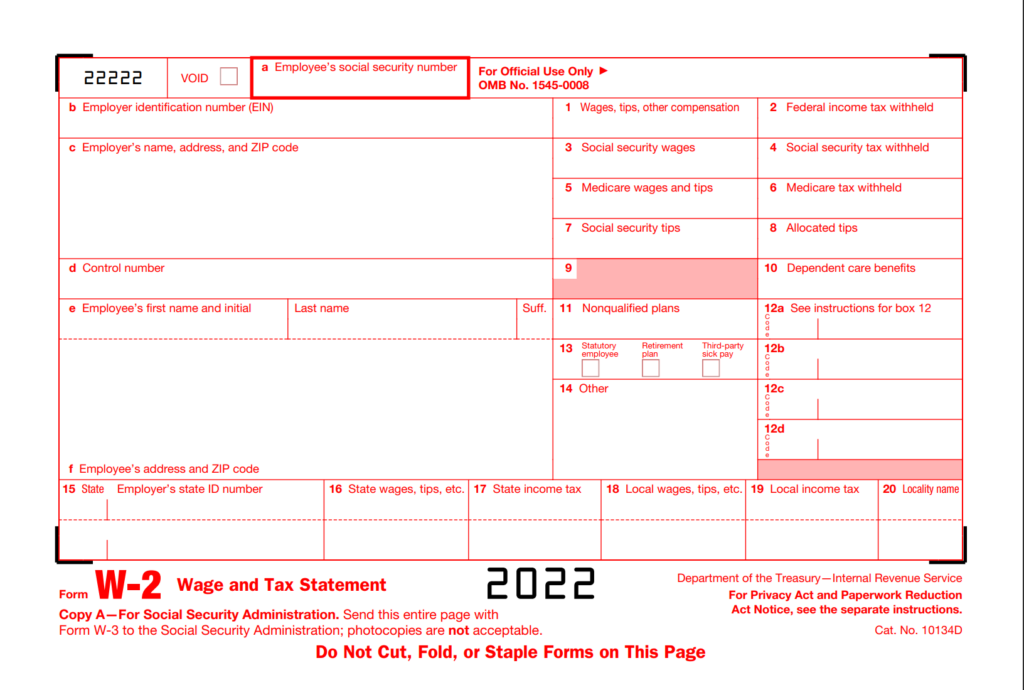

Soriana Employee W2 Form – Form W-2, also known as the Wage and Tax Statement, is the document an employer is required to send out to each worker and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports staff members’ yearly incomes and the quantity of taxes kept from their paychecks. A W-2 worker is somebody whose company subtracts taxes from their incomes and submits this info to the federal government.

How Can I Receive My W-2?

Your employer is needed to offer you with copies of your W-2 each year if you are qualified to receive one. The deadline for business to offer this form is generally by the end of January or early February following the tax year that simply ended. W-2s may be sent by mail as a hard copy or made available online in electronic form, either through the employer straight or by means of their payroll provider.

Download W2 Form 2022

How to Get Your Former Employer to Send You Your W-2 Form

You might be wondering how to get your W-2 form from your old company if you are a former worker. There are a couple of different methods to tackle getting this file.

The first thing you can do is call the HR department of your old employer. You can describe that you need a copy of your W-2 form and ask them to mail it to you. They will likely request your address so they can send it out or email it to you.

Another option is to get in touch with the company’s accountant or accountant and inquire for the file. They might have access to all of the company’s records, which indicates they will have the ability to give you a copy of your W-2 form without any inconvenience on their end.

If you need to find more information related Soriana Employee W2 Form please check the curated link listed below :

Disclosure Doc Credit Suisse

https://research-doc.credit-suisse.com/docView?language=ENG&format=XLS&document_id=1080381061&source_id=csplusresearch&serialid=k%2FklT8AA0vvUSmSMoCBmZYvFcyBSU6WaWP2JSGDIuyk%3D

Formmellon SEC Gov

https://www.sec.gov/Archives/edgar/data/1111565/000111156506000011/formmellon.htm

Supplier Responses To Wal Mart S Invasion Of Mexico

https://www.nber.org/system/files/working_papers/w17204/w17204.pdf

Return Of Organization Exempt From Income Tax

https://www.feedingswva.org/wp-content/uploads/2020/06/FY2012_FSWVA_IRS_990.pdf

Heavy Work Investment Amfiteatru Economic

https://www.amfiteatrueconomic.ro/temp/Article_2947.pdf

Nonprofit Explorer MERCY MINISTRIES OF LAREDO Full Filing

https://projects.propublica.org/nonprofits/organizations/200198462/201741329349306574/full

Tiendas Soriana SA De CV Overview News Competitors

https://www.zoominfo.com/c/tiendas-soriana-sa-de-cv/357897169

Guide To Environmental Requirements Social And Good Agricultural

https://fpsc-anz.com/wp-content/uploads/2015/02/shaffe-guide-to-international-retailer-qa-requirements-june-2011.pdf

Can A Canadian Ontario Corp Run Payroll Issue W2s 1099 For Its

https://www.quora.com/Can-a-Canadian-Ontario-Corp-run-payroll-issue-W2s-1099-for-its-US-residents-employees-If-so-what-does-it-need-in-US-to-do-that-EIN-Bank-account-Address-physical-or-virtual-Or-does-it-need-to-have-a-Corp-Delaware-or

Wage Tax Statement Form W 2 101 Taxes For Expats

https://www.taxesforexpats.com/articles/expat-tax-rules/form-w-2-wage-tax-statement-understanding-forms-you-might-need-for-your-us-tax-return.html