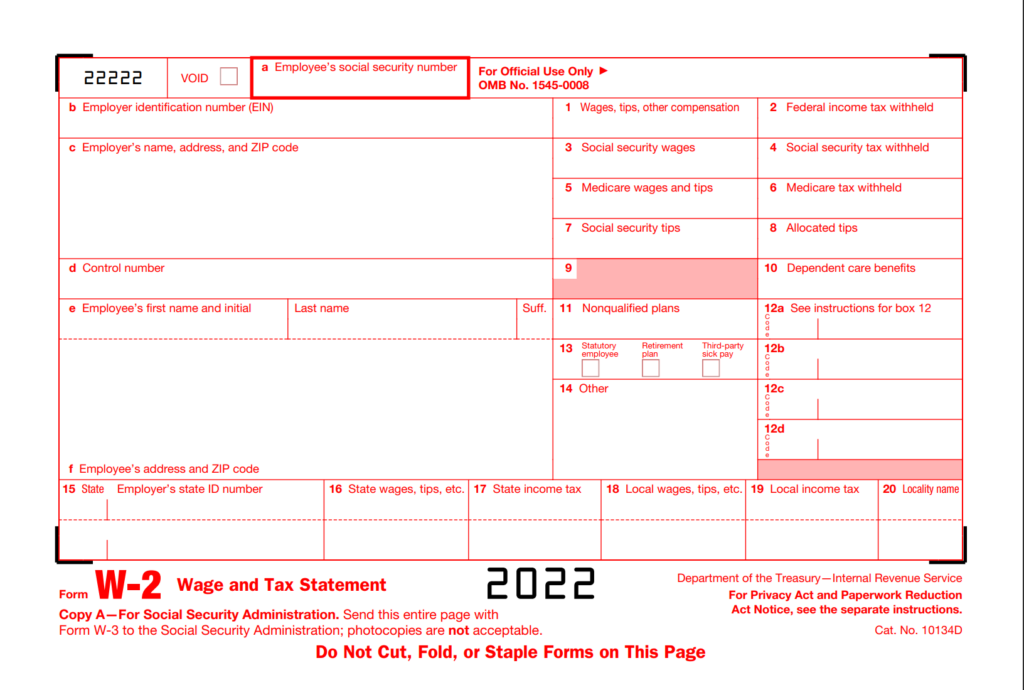

DoorDash Employee W2 Form – Form W-2, also known as the Wage and Tax Statement, is the document a company is required to send to each worker and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees’ annual earnings and the amount of taxes withheld from their incomes. A W-2 worker is somebody whose employer deducts taxes from their paychecks and sends this info to the federal government.

How Can I Obtain My W-2?

If you are eligible to get one, your employer is required to provide you with copies of your W-2 each year. The deadline for companies to supply this form is normally by the end of January or early February following the tax year that simply ended. W-2s may be sent by mail as a hard copy or provided online in electronic form, either through the employer straight or through their payroll provider.

Download W2 Form 2022

How to Get Your Former Employer to Send You Your W-2 Form

If you are a former worker, you may be questioning how to get your W-2 form from your old employer. There are a couple of different ways to set about getting this file.

The first thing you can do is call the HR department of your old company. You can explain that you need a copy of your W-2 form and ask them to mail it to you. They will likely request your address so they can send it out or email it to you.

Another alternative is to contact the company’s accountant or accountant and ask them for the document. They might have access to all of the business’s records, which means they will have the ability to provide you a copy of your W-2 form without any trouble on their end.

If you need to find more information related DoorDash Employee W2 Form please check the curated link listed below :

Does DoorDash Send You A W2 Yes If You Are Doordash

https://bestreferraldriver.com/doordash-w2.html

2022 Guide To Get Form W 2 From DoorDash Current And Former

https://www.wikiaccounting.com/get-form-w-2-from-doordash/

Dasher Guide To Taxes DoorDash Support

https://help.doordash.com/dashers/s/article/Common-Dasher-Tax-Questions?language=en_US

Guide To 1099 Tax Forms For DoorDash Dashers And Merchants

https://support.stripe.com/express/questions/guide-to-1099-tax-forms-for-doordash-dashers-and-merchants

Does DoorDash Send You A W2 In 2022 Try This Instead

How To Get Your 1099 Tax Form From DoorDash Alphr

https://www.alphr.com/doordash-get-1099-tax-form/

How Do I Get My 1099 From Doordash Stride Health

https://support.stridehealth.com/hc/en-us/articles/1500002201821-How-do-I-get-my-1099-from-Doordash-

DoorDash 1099 Taxes Your Guide To Forms Write Offs And More

https://www.keepertax.com/posts/doordash-1099

How Do I File Taxes When Partnering With DoorDash

https://help.doordash.com/merchants/s/article/How-do-I-file-taxes-when-partnering-with-DoorDash?language=en_US